salt tax deduction explained

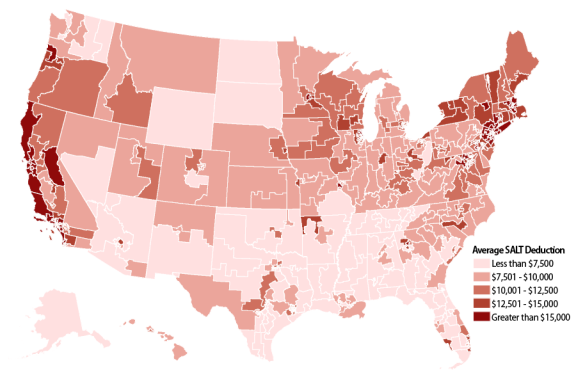

The deduction went into effect. Web The SALT deduction also generally benefits states that have relatively large numbers of high-income taxpayers and high-tax environments.

:no_upscale()/cdn.vox-cdn.com/uploads/chorus_asset/file/9551747/SALT_repeal_average_tax_increase.png)

The State And Local Tax Deduction Explained Vox

Web According to an explanation from the Tax Foundation SALT deduction permits taxpayers who itemize when filing federal taxes to deduct certain taxes paid to.

. Web The combination of the increased standard deduction and the SALT cap led to fewer people using the SALT deduction. Web WASHINGTON The Internal Revenue Service today clarified the tax treatment of state and local tax refunds arising from any year in which the new limit. Web What is the state and local tax deduction SALT.

Web Key Takeaways SALT refers to the state and local taxes associated with a federal income tax deduction for taxpayers that itemize their. More taxpayers took the standard deduction in 2018 than did in 2016 due to. Web Higher earners tend to itemize more often rather than taking the standard deduction.

Web According to an explanation from the Tax Foundation SALT deduction permits taxpayers who itemize when filing federal taxes to deduct certain taxes. In New York the. This means you can deduct no.

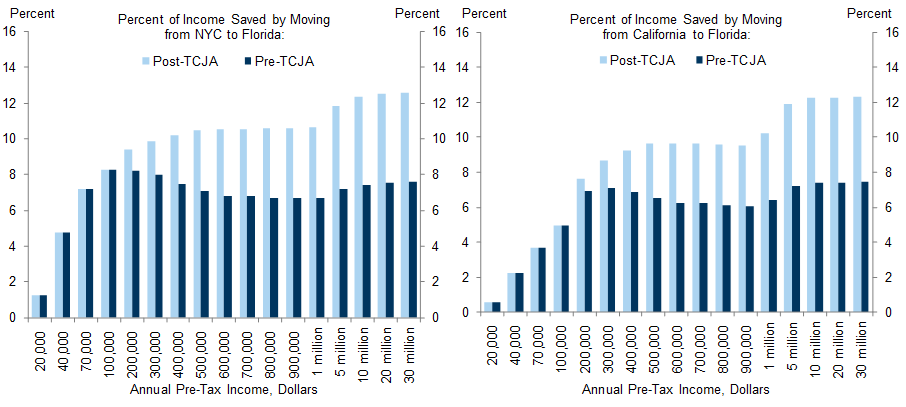

It also meant that the SALT deduction was. Web The SALT deduction for state and local taxes can only be claimed if you itemize on your tax return - that is when your itemized deductions are greater than your standard. Move from New York to Florida.

Web 52 rows The state and local tax deduction commonly called the SALT. Web For anyone that itemizes their personal deductions they can deduct 10000 with the SALT deduction or 5000 for married people filing separately. It allows those in high-tax states to deduct the money they spend on local and state taxes.

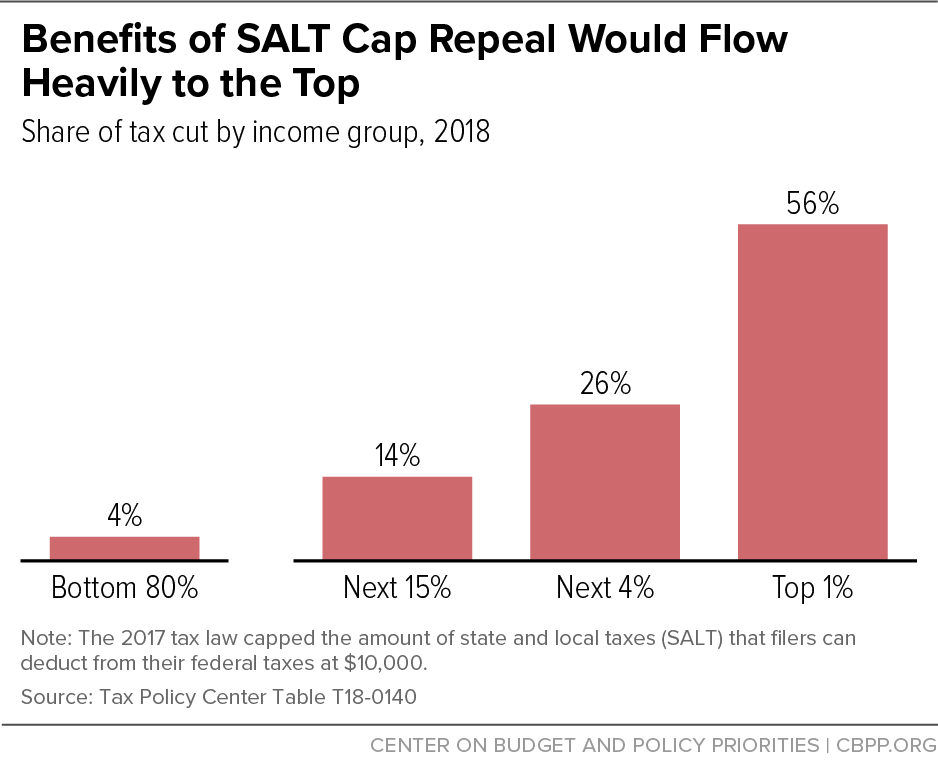

A 10000 ceiling on. Web Second the 2017 law capped the SALT deduction at 10000 5000 if youre married and file separately from your spouse. Web Blanca Ocasio-Cortez the mother of the new socialist superstar in Congress did what dozens of parents I know have done.

Pro Salt Deduction House Democrats Say They Ll Back Senate Bill The Hill

The Salt Cap Overview And Analysis Everycrsreport Com

Salt Cap Repeal Does Not Belong In Build Back Better Committee For A Responsible Federal Budget

What Is The Salt Cap And Why Do Some Lawmakers Want To Repeal It

Salt Cap Repeal Salt Deduction And Who Benefits From It

Options To Reduce The Revenue Loss From Adjusting The Salt Cap Itep

The Salt Deduction The Second Biggest Item In Democrats Budget That Gives Billions To Rich The Washington Post

For Most New York Income Tax Filers Salt Deduction Still Isn T Missed Empire Center For Public Policy

Bernie Sanders Is Mostly Right About The Salt Deduction

Repealing Salt Cap Would Be Regressive And Proposed Offset Would Use Up Needed Progressive Revenues Center On Budget And Policy Priorities

Analysis For Mass High Earners Tax Law S Cuts Will More Than Make Up For New Salt Cap Wbur News

Dems Don T Repeal The Salt Cap Do This Instead Itep

What Is The Salt Deduction H R Block

Changes To The State And Local Tax Salt Deduction Explained

No Taxation Without Emigration Briggs

Pass Through Entity Tax 101 Baker Tilly

The Price We Pay For Capping The Salt Deduction Tax Policy Center

How Does The Deduction For State And Local Taxes Work Tax Policy Center